The Life Insurance In Dallas Tx PDFs

Table of Contents6 Easy Facts About Truck Insurance In Dallas Tx ShownThe Home Insurance In Dallas Tx DiariesSome Ideas on Life Insurance In Dallas Tx You Need To KnowExamine This Report about Insurance Agency In Dallas TxExcitement About Commercial Insurance In Dallas TxA Biased View of Commercial Insurance In Dallas Tx

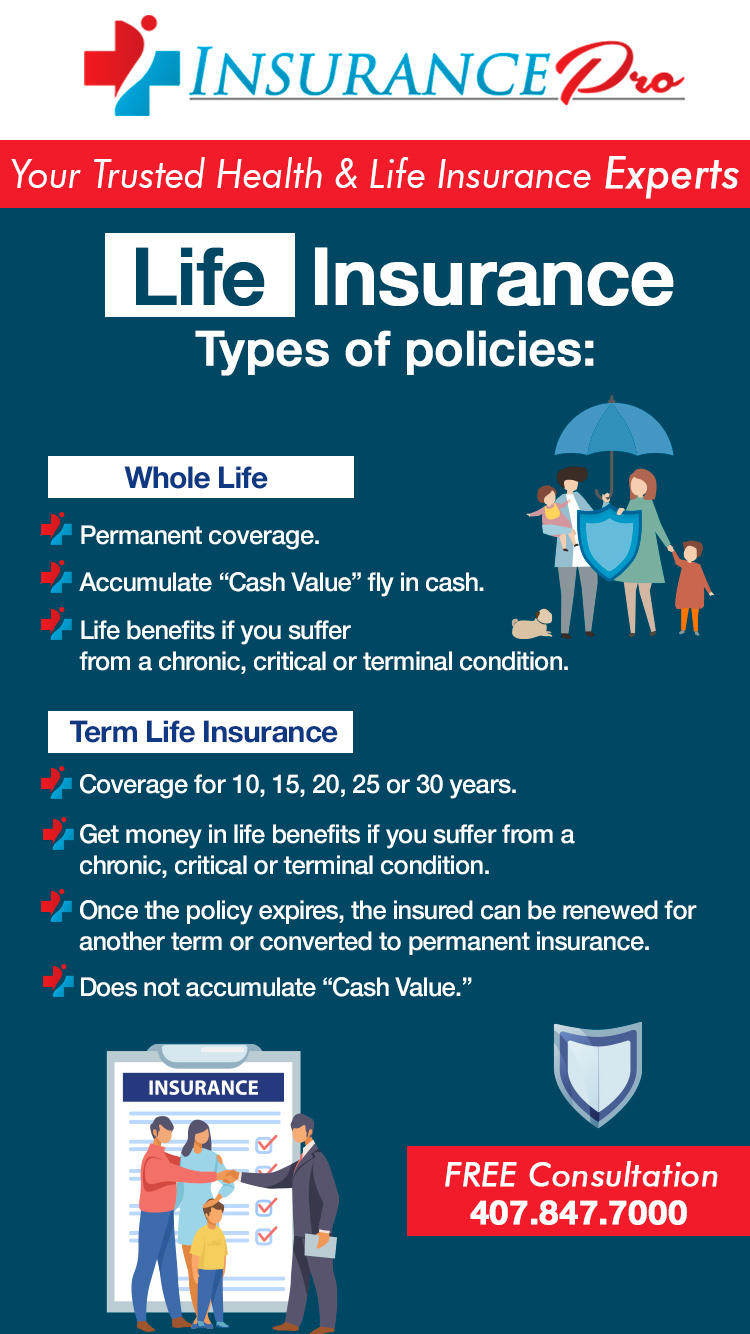

And also given that this protection lasts for your entire life, it can assist support lasting dependents such as children with impairments. Disadvantage: Price & intricacy a whole life insurance coverage plan can be considerably a lot more pricey than a term life plan for the very same survivor benefit amount. The cash money worth part makes whole life much more intricate than term life because of charges, taxes, rate of interest, and various other stipulations.

Bikers: They're optional attachments you can make use of to tailor your plan. Some plans include cyclists immediately consisted of, while others can be added at an extra cost. Term life insurance policy policies are generally the most effective solution for people that require cost effective life insurance policy for a specific period in their life.

All about Commercial Insurance In Dallas Tx

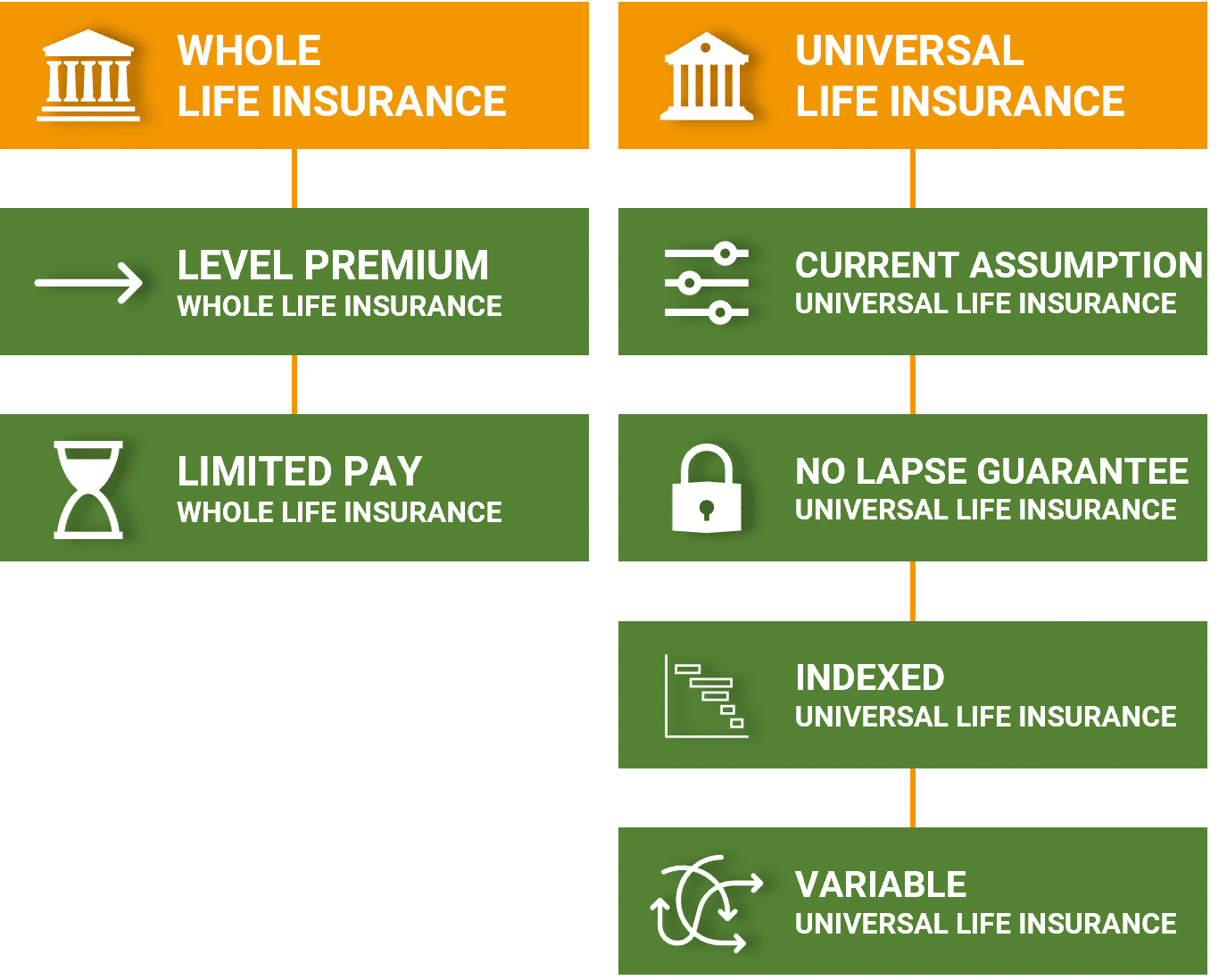

" It's always advised you talk to a certified agent to identify the ideal remedy for you." Collapse table Since you're acquainted with the fundamentals, below are additional life insurance plan kinds. Most of these life insurance policy alternatives are subtypes of those featured over, suggested to offer a particular function.

Pro: Time-saving no-medical-exam life insurance provides quicker accessibility to life insurance policy without needing to take the clinical exam (Health insurance in Dallas TX). Con: Individuals who are of old age or have multiple wellness problems could not be eligible. Best for: Anyone that has few health and wellness problems Supplemental life insurance policy, additionally called volunteer or volunteer supplementary life insurance policy, can be made use of to connect the coverage space left by an employer-paid group policy.

Unlike other plan types, MPI only pays the survivor benefit to your mortgage lender, making it a a lot more limited option than a conventional life insurance policy policy. With an MPI policy, the beneficiary is the home mortgage business or lender, as opposed to your household, and the fatality benefit lowers over time as you make home loan payments, comparable to a decreasing term life insurance policy plan.

Some Of Health Insurance In Dallas Tx

Because AD&D just pays out under certain situations, it's not an appropriate replacement for life insurance coverage. AD&D insurance only pays if you're hurt or killed in a crash, whereas life insurance pays for most causes of death. Due to this, AD&D isn't appropriate for every person, but it may be useful if you have a risky line of work.

Some Ideas on Health Insurance In Dallas Tx You Need To Know

Best for: Couples who don't receive two individual life insurance policy plans, There are two main kinds of joint life insurance policy policies: First-to-die: The policy pays after the initial of the 2 spouses passes away. First-to-die is the most comparable to an individual life insurance policy policy. It aids the surviving insurance holder cover expenses after the loss of financial backing.

What are the two primary kinds of life insurance policy? Term and also permanent are the two primary types of life insurance coverage.

Both its duration as well as money value make permanent life insurance policy several description times extra pricey than term. Term life insurance policy is usually the most affordable as well as extensive type of life insurance policy due to the fact that it's basic as well as offers financial security throughout your income-earning years.

The Ultimate Guide To Commercial Insurance In Dallas Tx

Entire, global, indexed universal, variable, as well as funeral insurance policy are all types of long-term life insurance. Permanent life insurance policy typically comes with a cash value and has greater costs.

life insurance policy market in 2022, according to LIMRA, the life insurance research organization. At the same time, term life costs represented 19% of the marketplace share in the exact same duration (bearing in mind that term life premiums are more affordable than whole life premiums).

There are four standard components to an Truck insurance in Dallas TX insurance policy agreement: Affirmation Web page, Insuring Contract, Exemptions, Conditions, It is essential to comprehend that multi-peril policies might have certain exemptions and also problems for each sort of protection, such as crash coverage, clinical payment protection, responsibility insurance coverage, and so forth. You will certainly need to ensure that you review the language for the certain insurance coverage that relates to your loss.

The Definitive Guide to Insurance Agency In Dallas Tx

g. $25,000, $50,000, and so on). This is a recap of the significant assurances of the insurance provider and also states what is covered. In the Insuring Agreement, the insurance firm concurs to do certain points such as paying websites losses for protected hazards, providing particular services, or consenting to protect the guaranteed in an obligation claim.

Examples of excluded residential or commercial property under a house owners policy are personal effects such as an auto, a family pet, or an airplane. Problems are arrangements inserted in the plan that qualify or place constraints on the insurance firm's guarantee to pay or carry out. If the plan conditions are not fulfilled, the insurance provider can deny the insurance claim.